Exploring the Growth and Future of the Oilfield Services Market

- ankit234586

- Jul 24, 2025

- 3 min read

The oilfield services market share reached a value of USD 311.65 Billion in 2024 and is expected to grow at a CAGR of 6.50% during the forecast period of 2025-2034, ultimately reaching USD 585.01 Billion by 2034. This robust growth trajectory highlights the evolving dynamics and increasing importance of oilfield services in the global energy ecosystem.

Understanding Oilfield Services

Oilfield services encompass a wide range of activities and solutions provided to oil and gas exploration and production (E&P) companies. These services include drilling, exploration, well intervention, completion, production, reservoir evaluation, and other technical services essential to the lifecycle of an oil and gas well.

While oilfield services are often perceived as being limited to drilling or seismic data, the sector has broadened its capabilities significantly with the inclusion of cutting-edge technologies such as IoT, AI, automation, and enhanced data analytics. These additions are helping operators optimize costs, reduce downtime, and improve safety standards across upstream operations.

Key Drivers Fueling Market Growth

Several pivotal factors are contributing to the expansion of the oilfield services market:

1. Rising Global Energy Demand

As global economies expand and industrial activities intensify, there is a consistent surge in energy consumption. Despite the growth of renewables, oil and natural gas remain integral to energy systems worldwide. This sustained demand directly correlates with increased drilling activities and investment in oilfield infrastructure.

2. Advancements in Drilling Technology

Technological advancements in drilling and completion techniques, such as horizontal drilling, multistage hydraulic fracturing, and managed pressure drilling, have enhanced oil recovery and extended the life of mature oilfields. These innovations are enabling service providers to offer more efficient and cost-effective solutions to oil companies.

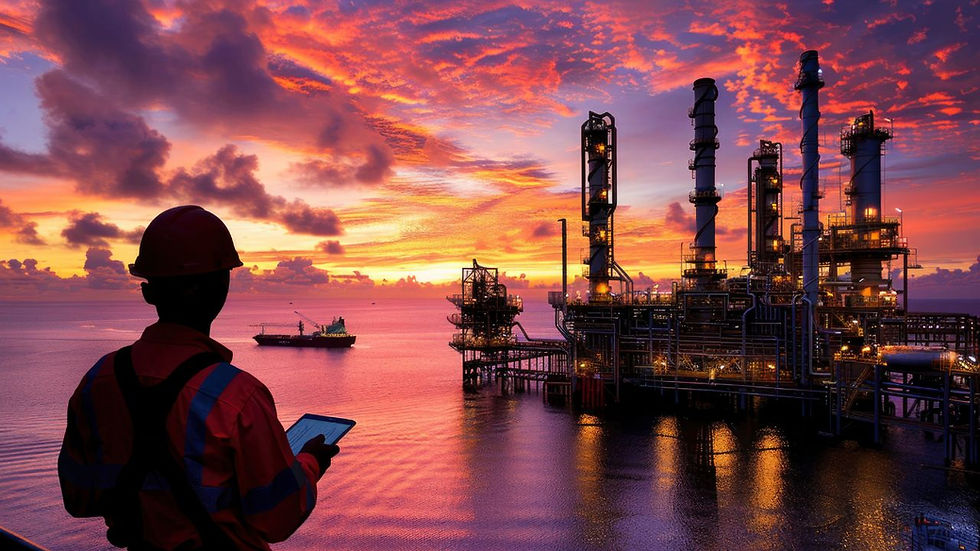

3. Resurgence of Offshore Projects

With the recovery in crude oil prices over recent years, investments in offshore exploration and production have bounced back. Regions like the Gulf of Mexico, the North Sea, and offshore Brazil are witnessing renewed interest, increasing demand for subsea services, rigs, and well intervention activities.

4. Digital Transformation and Automation

The integration of digital technologies in the oilfield has unlocked new efficiencies. Oilfield service providers are increasingly leveraging automation, remote monitoring, predictive maintenance, and real-time data analytics to enhance well productivity, reduce operational costs, and ensure worker safety.

Market Segmentation

The oilfield services market is segmented based on service type, application, and region:

By Service Type:

Drilling Services: Includes rig operations, directional drilling, and drill bit services.

Completion and Workover Services: Encompasses activities to enhance well productivity post-drilling.

Production Services: Maintenance and optimization of existing wells.

Seismic Services: Exploration-focused services including 2D and 3D seismic data acquisition.

By Application:

Onshore: Historically dominant due to lower operational costs and logistics.

Offshore: Gaining momentum due to large untapped reserves in deep and ultra-deep waters.

Regional Insights

1. North America

North America, particularly the United States, continues to dominate the oilfield services market. The rapid expansion of shale exploration and production in the Permian Basin and Eagle Ford Shale has fueled demand for drilling and hydraulic fracturing services. Canada's oil sands also contribute to regional service demands.

2. Middle East and Africa

This region holds substantial oil and gas reserves and consistently invests in upstream projects. Countries like Saudi Arabia, UAE, and Kuwait are expanding capacity, thus driving demand for drilling and completion services.

3. Asia-Pacific

The Asia-Pacific region is witnessing increasing exploration activities, especially in countries like India, China, and Indonesia. The growing energy consumption and dependence on oil imports are motivating governments to develop domestic oil reserves.

4. Latin America

Brazil and Argentina are notable players. Brazil’s pre-salt offshore fields and Argentina’s Vaca Muerta shale formation are key contributors to regional market growth.

Market Challenges

While the oilfield services industry is poised for strong growth, it does face several challenges:

Volatility in Crude Oil Prices: Sharp fluctuations in oil prices can lead to budget cuts and project delays, affecting the demand for services.

Environmental Concerns: Stricter environmental regulations and a push for decarbonization may slow down traditional E&P operations.

Skilled Labor Shortage: The growing reliance on advanced technologies demands a skilled workforce, which can be limited in some regions.

Future Outlook

The oilfield services sector is transitioning into a more tech-driven and efficiency-oriented industry. As global demand for energy persists, and operators seek to maximize returns from both mature and new reservoirs, the role of oilfield service providers will only expand.

The push for more environmentally responsible operations is also compelling companies to adopt greener technologies. Waterless fracking, cleaner drilling fluids, and carbon capture at well sites are examples of such innovations making their way into mainstream operations.

Furthermore, mergers and acquisitions (M&A) activity is expected to rise as service providers look to diversify their portfolios, reduce costs, and expand into digital and automation spaces.

Comments